Every year a massive number of entrepreneur aspirants from across the globe flock to Singapore in the pursuit of fulfilling their innate desire start a business venture in a promising economy.

They often end up doing company incorporation Singapore to pave the way for running a lucrative business.

As per the Doing Business report of prestigious World Bank, the Republic is one of the easiest nation in the world for doing business.

This recognition speaks significance of the fact that the island nation is a strong contender in the international business market.

They often end up doing company incorporation Singapore to pave the way for running a lucrative business.

As per the Doing Business report of prestigious World Bank, the Republic is one of the easiest nation in the world for doing business.

This recognition speaks significance of the fact that the island nation is a strong contender in the international business market.

Either an existing foreign company intending to expand its reach or an individual looking for a conducive economy to venture out his new business, Singapore is undoubtedly the best place for both.

Aspirants are likely to search for an economy endowed with pro-business policies, skilled manpower, tax-efficient structure, supportive government, etc., and surprisingly, Singapore has everything under its belt.

Below are the 5 reasons why you must consider the city-state for your company registration.

Aspirants are likely to search for an economy endowed with pro-business policies, skilled manpower, tax-efficient structure, supportive government, etc., and surprisingly, Singapore has everything under its belt.

Below are the 5 reasons why you must consider the city-state for your company registration.

- Company Incorporation Process is Easy: The process of company incorporation is something you must take into consideration before taking the final plunge. There are many jurisdictions in the world where the incorporation process is cumbersome, full of bureaucratic hurdles and time-consuming. But, Singapore is exceptional.

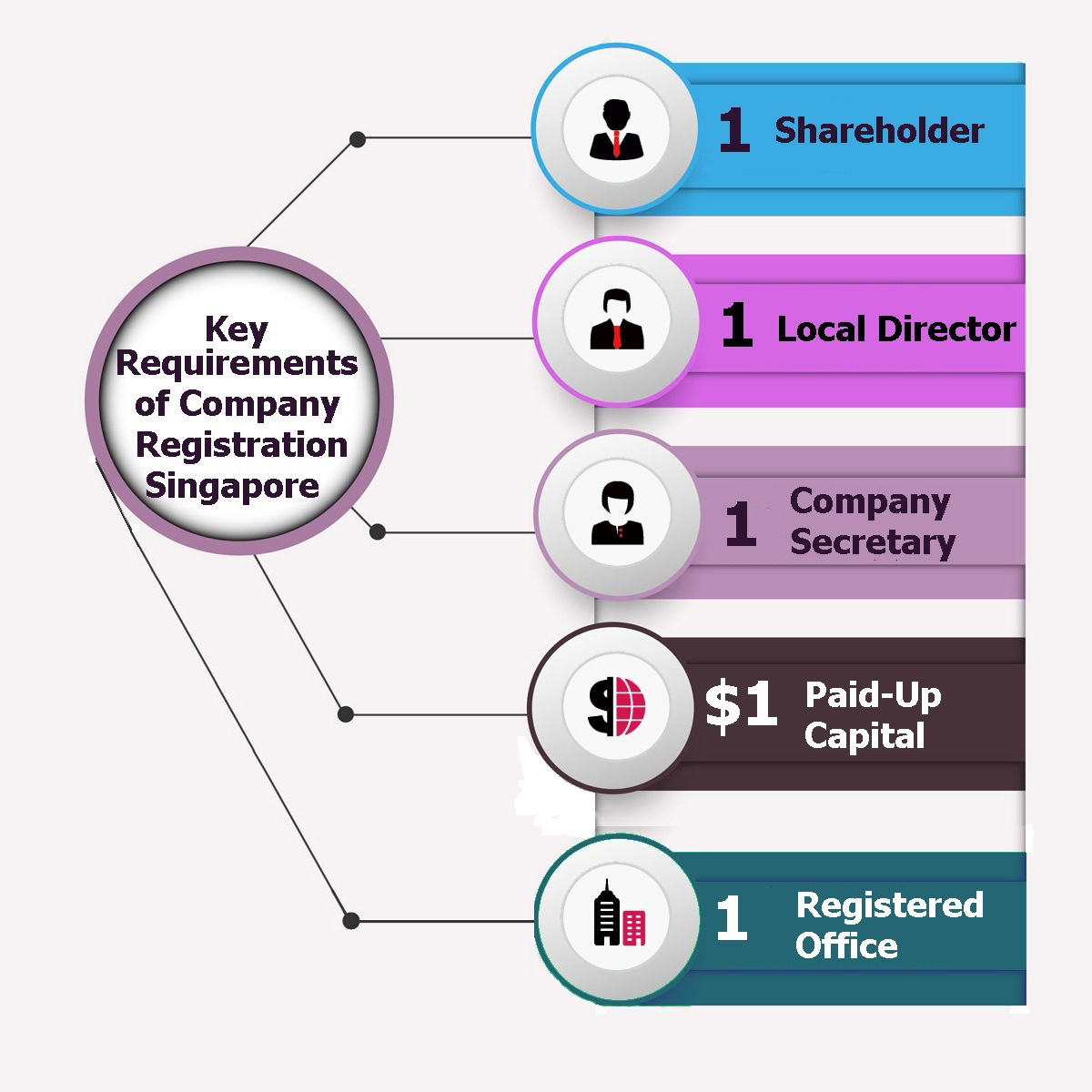

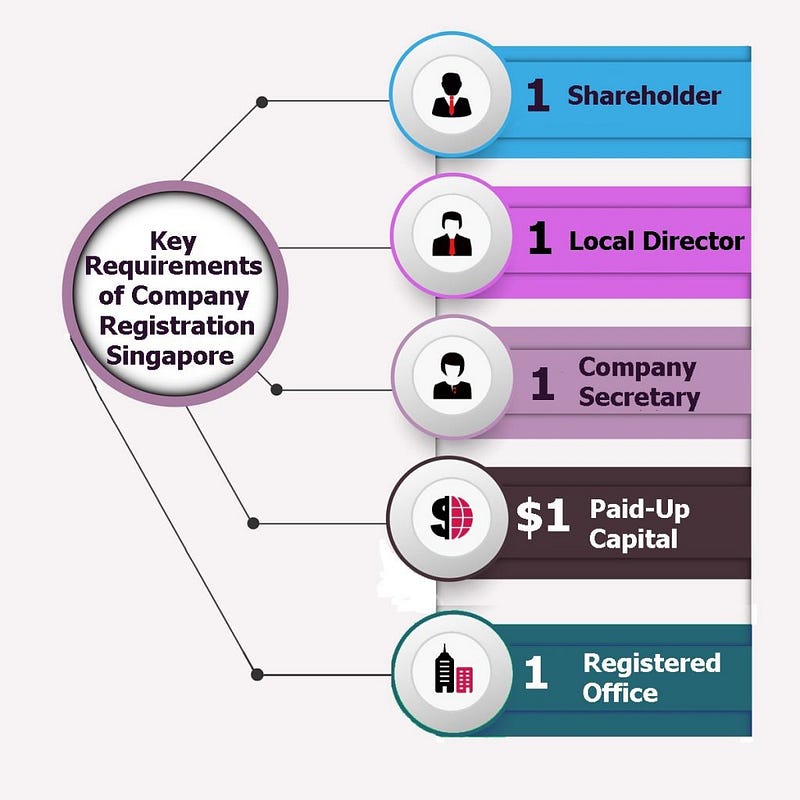

You just need to take two simple steps – 1) Company Name Reservation and 2) Company Registration (filing of application form). The entire process is computerized, and hence, it is easy, simple, convenient and fast. You can incorporate the company in a very less time given the documentation are in order.

For more: Company Registration Singapore – A Ready Reckoner

- Tax Structure is Progressive: One of the key perks of doing business in Singapore is its tax structure. The tax rates are comparatively low, and there is a series of tax benefits. It is not a hidden fact that everyone loves to keep as much earning as possible by paying minimal tax to the government. Luckily, Singapore government has wisely designed the tax structure of the country. It is pro-business.

The headline corporate income tax rate is 17%. The newly incorporated companies (whose annual revenue is below S$100,000) benefit from the full tax exemption scheme (0%) for the first three years. However, it is subject to fulfilling the certain requirements of the government. The new and existing companies may leverage the benefits of partial tax exemption under which the effective tax rate would be 8.5% if the annual revenue of the company is between S$100,000 to S$300,000. GST rate in Singapore is only 7%. And, the marginal tax rate of personal income tax for Singapore resident peaks at 22%.

Also Read: Definitive guide to registration Company Singapore Vs. Hong Kong

- Easy Access to Business Funds /Capital: Ease of access to fund/ capital for kickstarting the new business is a matter of concern for especially the newbies. It makes sense that individual often face funding issues at the time of bootstrapping. Thanks to Singapore government and other private investors, venture capitalists and angel investors, who help the startups to lay a strong foundation of the business by providing funding assistance.

The government has rolled out a series of funding assistance in the form of cash grants, incubator schemes and equity programs for start-up businesses.

- Strategic Location: We cannot deny the fact that most of us search for a business location which is easily accessible from our native place. Thanks to the strategic location of the island nation, which is placed at the cross roads of East and West. The historic Singapore port has long been known for international trade. The country’s award-winning Changi International Airport is well connected with major cities of the world (approx. linking 300 cities from 70 countries). People from both regions can reach Singapore within a few hours of flight. It is one of the added advantages of doing business on the shores of Singapore.

- Skilled Workforce: Last but not the least, the talent, experience and skills of manpower of country has to be considered when you are planning to run a business out there. A business would benefit from highly skilled workforce when it comes to productivity. The presence of globally recognized universities, colleges, and institutions ensure that the local workforce has received the world-class education. They can conduct business in English, and they are highly competent on a global arena. The availability of talented resources makes the island nation a regional or global hub of business.

If you are searching for endless business opportunities for your venture, then there is no better place than Singapore. The factors mentioned above have already explained the reasons very well. So, what are you waiting for? No matter whether you are going to expand your existing business or bootstrapping a new one, Singapore business incorporation is the best bet for you.

SBS Consulting Pte Ltd is a leading firm offering best packages for company incorporation Singapore. One can avail the most competitive services from the incorporation experts at the firm. High-quality service, promptness in delivery and competitiveness in pricing are the words synonyms with SBS Consulting.