So, you are

convinced to incorporate a company in Singapore after doing plenty of

research and due diligence on the market. Now, it is important for you

to know the type of company or business structure that the jurisdiction

has. You must pick the best and right one for your company incorporation Singapore process.

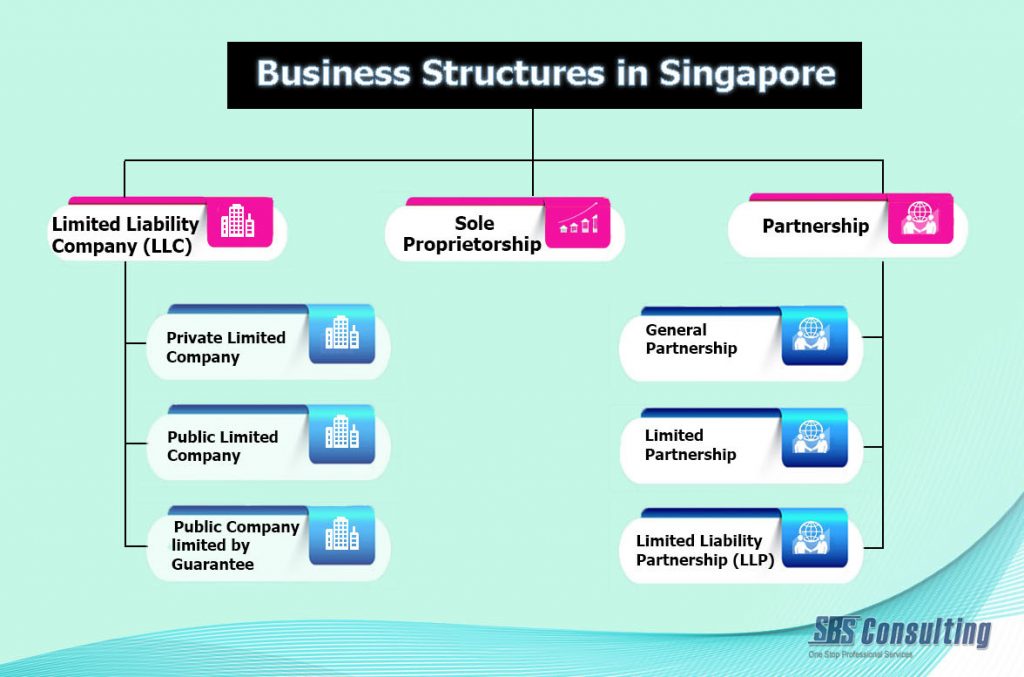

There are mainly five types of business structures in Singapore.

This blog excerpt will outline the details about the various types of business entity in Singapore so that you can easily select the best and most suitable structure for your upcoming venture.

Limited Liability Company (LLC)

An LLC is a company limited by shares. The liabilities of the company are limited to the amount of share capital. It is registered under the Singapore Companies Act with authority called ACRA (Accounting & Corporate Regulatory Authority). There are three types of company in Singapore.

Public Limited Company by Guarantee: It is meant for non-profit organizations like NGOs, associations, societies, etc.

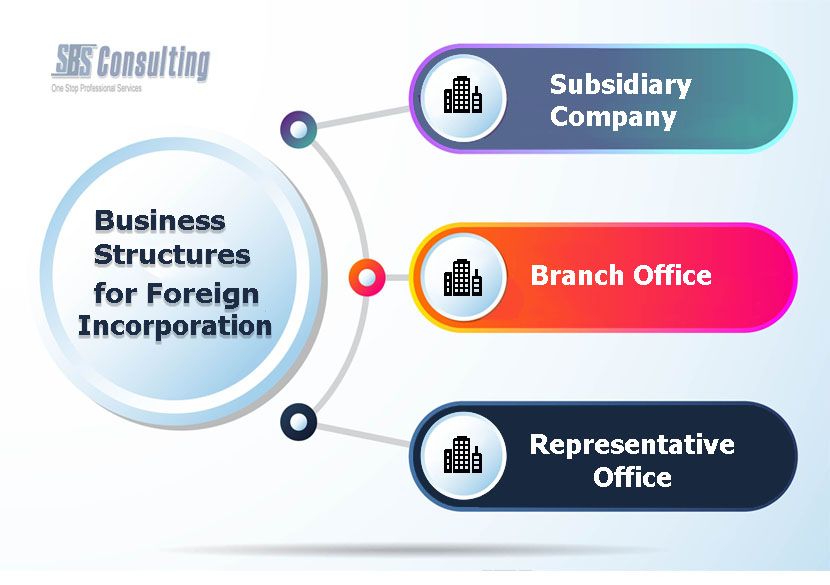

There are types of company incorporation options available for foreign entities.

A sole proprietorship is a business structure owned and managed by a single owner. It is the simplest form of business formation in Singapore. The owner and the business are same. The owner will bear all the expense and liabilities incurred by the business. It is prone to financial risk. So, it is not recommended for serious entrepreneurs.

Partnership

A partnership business is owned by two or more partners. It has no legal identity and thus, not separate from its partners. The existence of the firm depends on the member. It comes to an end with insolvency, retirement or death of a partner. There are three types of partnership.

Contact Info:

SBS Consulting Pte. Ltd.

Visit: https://www.sbsgroup.com.sg/

High Street Centre,

#17–02, 1 North Bridge Road,

Singapore — 179094

Tel: (65) 6536 0036

Email: info@sbsgroup.com.sg

There are mainly five types of business structures in Singapore.

- Company (Limited Liability Company)

- Sole Proprietorship

- Partnership

- Limited Partnership

- Limited Liability Partnership

This blog excerpt will outline the details about the various types of business entity in Singapore so that you can easily select the best and most suitable structure for your upcoming venture.

Limited Liability Company (LLC)

An LLC is a company limited by shares. The liabilities of the company are limited to the amount of share capital. It is registered under the Singapore Companies Act with authority called ACRA (Accounting & Corporate Regulatory Authority). There are three types of company in Singapore.

- Private Limited Company

- Public Limited Company

- Public Limited Company by Guarantee

- A private limited company has its own legal identity, district from its members (shareholders and directors).

- The liability of the shareholders is limited to the amount of money they invested in the company.

- Raising capital is easy. It can be done by bringing in new shareholders or issuing more shares to existing shareholders.

- Credibility image of a private limited company is better than other structures like the sole proprietorship, partnership, and LLP.

- Perpetual succession. The company continues to endure even after the separation of any of the member.

- Ownership of the company can be transferred either wholly and partially.

- The tax benefits and allowances for the private limited company are plenty.

Public Limited Company by Guarantee: It is meant for non-profit organizations like NGOs, associations, societies, etc.

There are types of company incorporation options available for foreign entities.

- Subsidiary Company: A Singapore subsidiary is a private limited company whose major shareholder is a foreign company. Nevertheless, it is distinct from its parent company.

- Branch Office: A branch office is a mere extension of its parent company.

- Representative Office: It is temporary set up for conducting market research related activities to explore the potentialities. A representative office is not a legal entity and cannot conduct any business activities.

A sole proprietorship is a business structure owned and managed by a single owner. It is the simplest form of business formation in Singapore. The owner and the business are same. The owner will bear all the expense and liabilities incurred by the business. It is prone to financial risk. So, it is not recommended for serious entrepreneurs.

Partnership

A partnership business is owned by two or more partners. It has no legal identity and thus, not separate from its partners. The existence of the firm depends on the member. It comes to an end with insolvency, retirement or death of a partner. There are three types of partnership.

- General Partnership - Each partner can be held liable for any misconduct or any wrong actions of another partner.

- Limited Partnership - There will limited partner with general partner. The liabilities of the limited partner are limited to the amount of capital they have invested in the partnership.

- Limited Liability Partnership - Out of three partnership structures, LLP is the most advanced and latest partnership in Singapore jurisdiction. The features of an LLP are the combination of partnership and company. An LLP is meant for professionals like the accountant, lawyer, architect, etc.

Contact Info:

SBS Consulting Pte. Ltd.

Visit: https://www.sbsgroup.com.sg/

High Street Centre,

#17–02, 1 North Bridge Road,

Singapore — 179094

Tel: (65) 6536 0036

Email: info@sbsgroup.com.sg